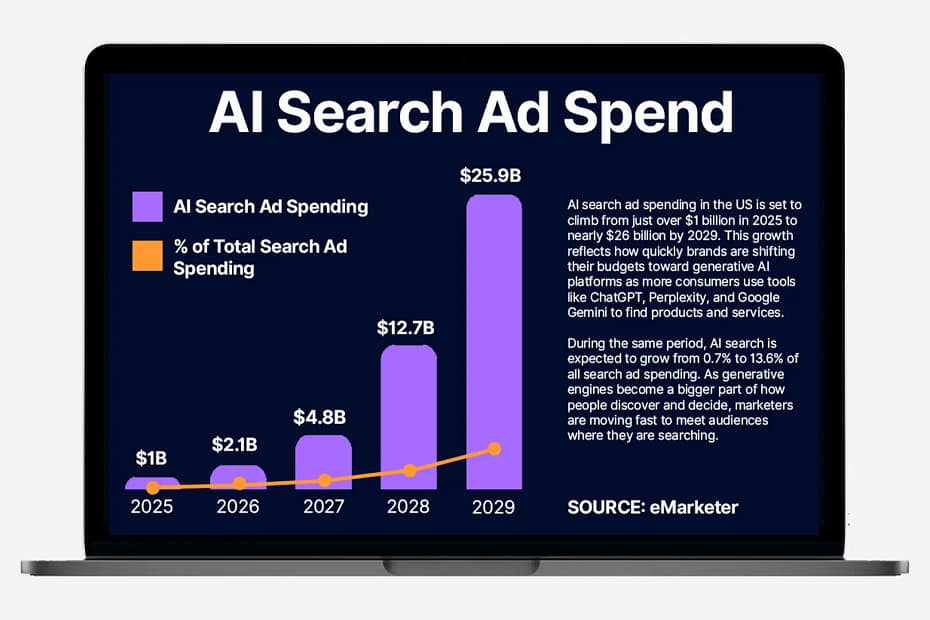

The AI search ads forecast is showing us a major shake-up in the advertising world. According to eMarketer’s 2025 report, US advertisers are set to spend $25.9 billion on AI-powered search ads by 2029. That’s 13.6% of all search ad spending, a huge jump from just $1.04 billion in 2025.

This growth over the next four years tells us AI search ads aren’t just a side experiment anymore. They’re becoming a key means for brands to connect with people. But the raw numbers only tell part of the story. Let’s dig into what this AI search ads forecast really means and how you can navigate it without getting lost.

What are AI Search Ads?

If you’re wondering what AI search ads are, you’re not alone. They’re different from the old-school keyword ads you see on search engine results pages. Instead, AI search ads show up in generative AI tools such as ChatGPT, Google Gemini, and Perplexity. They can also appear in AI-powered summaries like Google AI Overviews and Bing AI summaries.

Here’s how they work: imagine you ask an AI, “What’s the best smartwatch?” The response might include a sponsored mention for a brand like Apple, slipped naturally into the answer, maybe with a link.

These ads pop up based on your casual question, not a set keyword. And they’re priced by cost-per-click, engagement, or impressions, and always tailored to the conversation.

Breaking Down AI Search Ad Options for Brands

So, what kinds of AI search ads can brands actually use right now? The landscape is still young, but here is what’s out there currently. These options are in various stages. Some are live, some are in testing, and others are on the horizon.

- Sponsored Answers: Platforms like Perplexity are already experimenting with sponsored follow-up questions. After answering your smartwatch query, it might suggest, “Want to see top deals?” with branded links. It’s subtle, blending into the chat, and brands pay per click or engagement. Google’s AI Overviews are also testing this, though it’s limited to select advertisers in the US for now.

- Compare & Decide Ads: Microsoft’s got a cool trick up its sleeve with these. Imagine a table comparing smartwatch features, battery life, price, with sponsored entries from brands like Samsung. It’s in closed beta for 2024, targeting retail and travel, and uses feed data to stay relevant. This could be a game-changer for decision-heavy purchases.

- In-Line Product Carousels: Picture a row of smartwatch images popping up mid-conversation on ChatGPT or Gemini. OpenAI’s hinting at this with internal plans for 2026 ad revenue, while Google’s AI Mode experiments show similar carousels. Brands supply product feeds, and the AI slots them in naturally, charged per impression or click.

- Conversational Ads: Microsoft’s pushing these through its Ads for Chat API, letting partners like Snapchat weave ads into chatbot flows. A user asking about fitness might get a sponsored tip for a Nike product. It’s early days, with Snapchat and Axel Springer testing since 2023, but it’s promising for real-time engagement.

- Top or Bottom Placements: Google’s AI Mode ads, rolled out as an experiment in 2025, place text or shopping ads above or below AI responses. After answering your query, it might add, “Check these options,” with sponsored links. It’s automated via broad match and Performance Max, giving brands less control but tapping into AI’s reach.

Are they fully here yet? Not quite. Google’s testing is US-only, Microsoft’s betas are selective, and OpenAI’s $25 billion ad goal by 2029 suggests ChatGPT ads are still in planning. Perplexity’s the furthest along with live sponsored questions. Brands can start experimenting where available, but it’s a bit like testing a new recipe. Tweak as you go.

The Data: A Steady Climb Over Four Years

The AI search ads forecast from eMarketer lays out a clear path of growth. It starts at $1.04 billion in 2025, which is just 0.7% of search ad spending. Then it rises to $2.08 billion in 2026 (1.3%), $4.77 billion in 2027 (2.8%), $12.65 billion in 2028 (7.0%), and hits $25.93 billion by 2029 (13.6%). That’s a compound annual growth rate of over 120%, a number that shows just how fast this is taking off, with a big jump between 2028 and 2029.

What’s driving it? People are starting to use these tools more. A YouGov survey from found that 38% of US adults rely on AI summaries for half or more of their searches, which means it’s becoming a normal habit. But not everyone’s on board. According to Pearl’s data, 29% of people who don’t use AI prefer talking to real humans, pointing to a trust issue that brands need to consider.

Why This Matters: Traditional Search Is Losing Ground

This growth in the AI search ads forecast suggests that the old way of doing search advertising, dominated by Google’s keyword auctions, might be running out of steam. As more people turn to AI chats and overviews instead of search engine results pages, the old tricks for ranking high aren’t as effective. By 2029, AI search ads could take nearly one in seven ad dollars, and that share might grow even more if adoption speeds up beyond what eMarketer predicts.

A Counterpoint: Are Clicks Disappearing?

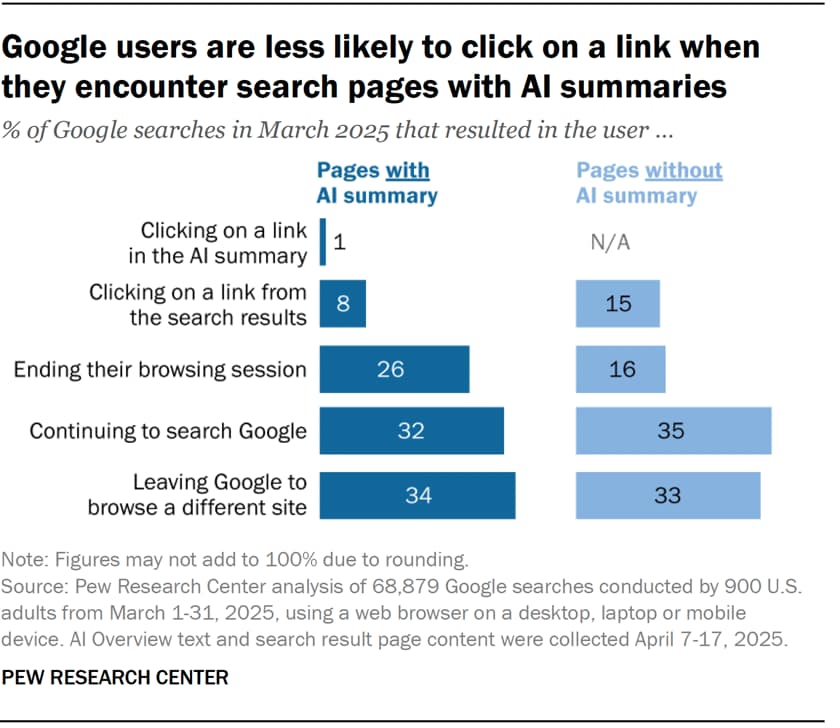

Here’s where it gets tricky. A Pew Research Center report throws a curveball at this optimism. They studied 900 US adults and found that 58% encountered an AI summary in their Google searches during March 2025. The catch? Users clicked on traditional links only 8% of the time with a summary, compared to 15% without one, nearly half as often.

Even worse, just 1% clicked on the sources cited in those summaries. Plus, 26% of users ended their session after seeing a summary, versus 16% without, meaning they’re walking away instead of exploring.

Publishers are freaking out about this, blaming AI Overviews for slashing their traffic since they launched last year. Pew’s data backs them up, showing two-thirds of searches end without a click, summary or not.

It’s a reality check: if people stop clicking, that $25.9 billion might not deliver the traffic brands expect. The summaries, often pulling from Wikipedia, YouTube, and Reddit (15% of sources), or government sites (6% vs. 2% in standard results), might be answering questions so well that users don’t need to dig deeper.

It’s not just about money. It changes how people find and connect with brands. AI search ads work in a flexible, context-driven space, where a brand mention might come up naturally in response to a question.

This opens doors for creative campaigns, but it also brings challenges, like figuring out how to measure a mention in a ChatGPT answer or dealing with AI mistakes that could hurt trust.

Opportunities for Brands: Get Ahead of the Game

For brands ready to adapt, this AI search ads forecast offers a real chance to shine. Jumping in early means you can stake a claim in a less crowded space. AI ads often cost less per engagement because of their conversational approach, which could mean better returns, especially for niche markets. Plus, AI engines tend to favor high-quality content, so investing in original research and clear insights can pay off big.

The YouGov stat backs this up: with 38% of adults using AI summaries, brands that make their content easy for these tools to understand, like with FAQs or knowledge graphs, can reach more people.

Testing platforms like Perplexity AI, which mixes search and generative AI, could be a smart move too. But Pew’s findings suggest a twist, if summaries kill clicks, brands need to ensure their content gets featured in those summaries or finds other ways to engage, like through conversational ads that invite action.

On the flip side, the Pearl data reminds us that 29% of non-users want human interaction. That suggests AI alone isn’t enough. Brands can pair AI-driven discovery with human touches, like personalized chats or forums, to build trust and make the experience feel more real.

Challenges Ahead: Watch Out for Roadblocks

Getting to $25.9 billion in this AI search ads forecast won’t be smooth sailing. AI ad platforms are still figuring things out, with sponsored features like those on ChatGPT just starting to roll out, and consistency varies.

Regulations might kick in by 2029, especially around transparency and bias in AI content, which could change how these ads work. Plus, tracking performance isn’t as straightforward as with traditional search, so brands might need new tools to keep up.

Pew’s data adds another layer: if AI summaries reduce clicks to 8% and end sessions at 26%, the challenge is real. Brands might pour money into AI search ads only to see less traffic, especially if summaries rely heavily on a few sources like Wikipedia or YouTube, as shown in the chart below where Wikipedia and government sites dominate.

There’s also a risk if AI engines favor big brands or certain content types, leaving smaller players struggling. The key is to build solid, authentic content that stands out on its own merits, not just gaming the system.

Looking Forward: Prepare for 2029 Now

The AI search ads forecast is a wake-up call for brands. Starting to adapt today can set you up as a leader in this AI-driven future. That might mean checking your content to see if it works with AI, testing ad formats on generative platforms, or keeping an eye on how people feel about these tools. As the market grows, best practices will likely focus on being authentic, relevant, and blending human elements.

By 2029, AI search ads could totally change how brands are seen, turning recommendations into a key advantage. The $25.9 billion figure is more than a goal, it’s a sign to innovate. For now, the focus should be on experimenting and learning from the trends we already see.

Final Thoughts

The rise of the AI search ads forecast from 2025 to 2029 is a big deal. With 13.6% of search ad spending on the line, the move from keyword-based to conversational AI strategies is clear. Supported by 38% of people using AI summaries and balanced by 29% who prefer humans, it brings both opportunities and hurdles.

Pew’s insight about fewer clicks adds a caution, but by understanding the AI search ads forecast and taking action early, brands can turn this shift into a strength and stay visible and trusted in an AI-powered search world.

Trularity analyzes how AI is transforming the economics of search, advertising, and brand visibility. Through independent research, emerging-trend analysis, and market forecasting, we study how AI-powered discovery, summaries, and agentic systems reshape where ad dollars go (and how brands get seen). Our goal is to help marketers navigate shifting behaviors, measurement challenges, and the new dynamics of AI-driven attention, so they can stay competitive as search advertising evolves into a fully conversational, multi-modal ecosystem.